....

Official Bernie Sanders for President 2016 thread

Collapse

X

-

-

#562Oh IDK, under Clinton taxes were raised exponentially. Where was the debt then?

Since you are a fan, listen closely to Trump's message on taxing. A one time tax on the rich of 10%, taxing wall st

speculators etc. Do you think he will get elected talking like a Dem?

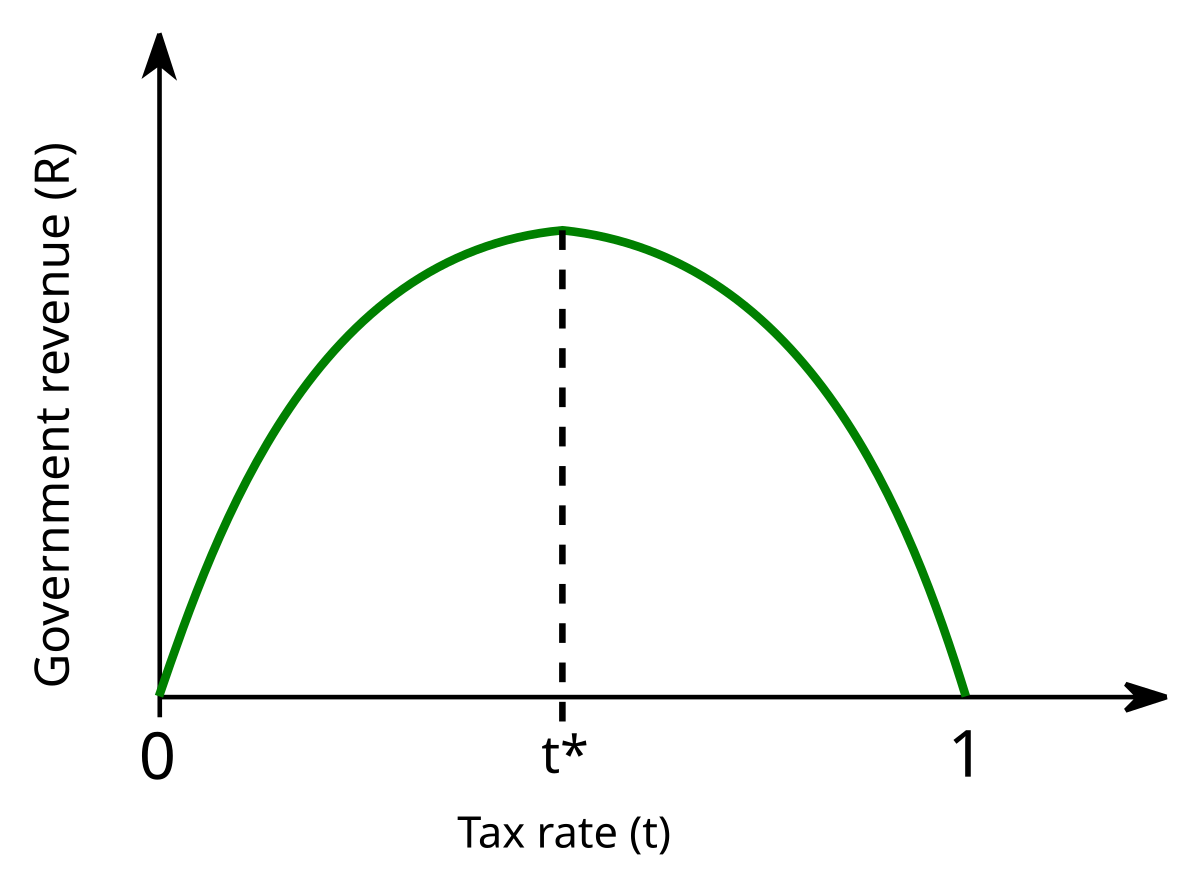

Repubs don't use math. They have this graph or a curve they go by. This graph/ curve depicts the supposed tax income received, by cutting corporate and the rich taxes.

Corporations still left America to go overseas even when their tax rates were reduced. Why do Repubs still try to

push that shit? Another example of failed policies. Trump and Bernie are the only one's talking about bad trade deals.Comment -

#563Here's that curve I was talking about.

Comment

Comment -

#564you economic moron! once again... in the late 40's/early 50's, debt was 144% of GDP (aka much higher than today). we didn't scream, "OMG debt! cut spending!" instead we grow our way out with economic expansion spurred by a high tax rate and government investment.

of course being the simpleton you are it's easier for you to scream, "OMG really big number" than it is to look at the finer points.Comment -

-

#566you economic moron! once again... in the late 40's/early 50's, debt was 144% of GDP (aka much higher than today). we didn't scream, "OMG debt! cut spending!" instead we grow our way out with economic expansion spurred by a high tax rate and government investment.

of course being the simpleton you are it's easier for you to scream, "OMG really big number" than it is to look at the finer points.

you have no idea what you're talking about as usual. You have no idea what our real debt is clearly. Stop reading vox BS, you'll sound a lot less stupid. The logic you are using to comparing 40/50s is asisine and shows what a lack of understanding you have on the large economical differences. Cut spending is the only option, you can't beat math you putz. Stop trying.

raising taxes will make no difference as a calculator shows us. You can tax the wealthy at 100% it will make no difference. That doesn't even factor in the negative effects of high taxes that we see all across the world.Last edited by brooks85; 11-01-15, 06:05 PM.Comment -

#567the rebuttal of a moron! economics are economics you dumbass.Comment -

#568yes, math is really stupid! Good point scumbag! Fact is you can tax at 100% it will make no difference. Fact is you have to cut spending. Fact is you don't even know what our real debt and spending problem is about.

and "economics are economics" means nothing.

and how about hike in minimum wage in Seattle? ... lol. They call that the Cobra Effect. Just like raising taxes now would only makes things worse.Last edited by brooks85; 11-01-15, 06:50 PM.Comment -

#569you obviously suck at math if you think this is a factFact is you can tax at 100% it will make no difference.Comment -

#570The only people those nitwits are fooling are people dumber than themselves. I say about eight people around the country would be pretty close.it just make me crazy when individuals like brooks and dwightie attempt to fake people out with a make believe intellect. ask them one question about anything from A to Z and they disengage, quit or do a blah blah blah act. boils my blood when I know, and you know and everyone knows that they are fakes.

okay, I am finished for the evening, good ahead guys do your thing.Comment -

#571Your calculator is broke. Change the battery. When that's changed, show me how cutting taxes pays for your salary.you have no idea what you're talking about as usual. You have no idea what our real debt is clearly. Stop reading vox BS, you'll sound a lot less stupid. The logic you are using to comparing 40/50s is asisine and shows what a lack of understanding you have on the large economical differences. Cut spending is the only option, you can't beat math you putz. Stop trying.

raising taxes will make no difference as a calculator shows us. You can tax the wealthy at 100% it will make no difference. That doesn't even factor in the negative effects of high taxes that we see all across the world.Comment -

#572as I have already proved about you many times, your math skills are non-existent so your opinion is truly worthless. I just proved it in another thread for you, go have a look.

And cutting taxes would be great for any business owner. Basic economics rkelly. It is like you try to make it known you are ignorant on any aspect of economics.Comment -

#573Raising taxes to the rate seen in 40's & 50's would obviously make a difference. Anyone who denies this is retarded. You're retarded because it would have to make a difference mathematically & secondly you're retarded because your interests shouldn't align with billionaires in the 1st place.Comment -

#574Raising taxes to the rate seen in 40's & 50's would obviously make a difference. Anyone who denies this is retarded. You're retarded because it would have to make a difference mathematically & secondly you're retarded because your interests shouldn't align with billionaires in the 1st place.

oh look, someone else I have proved wrong many, many times. Coincidence?

Fact is you have no idea what you're talking about as usual sheepy.Comment -

#575they take in 4 trillion a year in taxes and will have a 20 trillion debt next year. The problem isn't the amount of taxes collected, there is plenty. Government has a spending problem. They are addicted to spending your money. There is no accountability. Blame the rich is their solution. Throw more money at any given problem is their solution. Blame the other guy is their solution. They are incompetent and stupid. These idiots have convinced several of you, that raising taxes is the solution. It isn't. Government assumes people are retarded because they will keep electing these idiots and buy into this "higher taxes are needed" nonsense.Raising taxes to the rate seen in 40's & 50's would obviously make a difference. Anyone who denies this is retarded. You're retarded because it would have to make a difference mathematically & secondly you're retarded because your interests shouldn't align with billionaires in the 1st place.

Give government 5 trillion they will spend 6. Give them 6 they will spend 7.Last edited by DwightShrute; 11-02-15, 10:52 AM.Comment -

#576 Comment

Comment -

#577^^if only there was a way to determine which economic theory was better for our collective debt. oh... wait... there is (debt as a % of GDP from the 1960's until now).Comment -

#578[IMG]https://****************************/hphotos-xtp1/v/t1.0-9/12122752_747863908680982_258336133127650 2941_n.jpg?oh=e376d79dee256144feff408efe fc330a&oe=56F98DFB[/IMG]Comment -

#579 Comment

Comment -

#580[IMG]https://****************************/hphotos-xtp1/v/t1.0-9/12191676_10153116758195986_2007255088419 850653_n.jpg?oh=8418185f56b362425286470e 2fb082f1&oe=56B158AC[/IMG]Comment -

#581Clearly we need to give the govt more money, they have shown to be very fiscally responsible with itComment -

-

#583Instead of blaming billionaires for your failures, look in the mirror. You're broke because you fuckin suck at lifeComment -

#584In 1993 the top income tax bracket went from 31% to 39.6%, that's not exponential, it's fractional. In 1997, Clinton cut the top capital gains bracket from 29.2 to 21.2. The only republican to give a larger capital gains cut was Warren Harding.Oh IDK, under Clinton taxes were raised exponentially. Where was the debt then?

Since you are a fan, listen closely to Trump's message on taxing. A one time tax on the rich of 10%, taxing wall st

speculators etc. Do you think he will get elected talking like a Dem?

Repubs don't use math. They have this graph or a curve they go by. This graph/ curve depicts the supposed tax income received, by cutting corporate and the rich taxes.

Corporations still left America to go overseas even when their tax rates were reduced. Why do Repubs still try to

push that shit? Another example of failed policies. Trump and Bernie are the only one's talking about bad trade deals.Comment -

#585They did cut spending dramatically. All that WW2 spending came to an end. Most of that "investment" went to the Pentagon.you economic moron! once again... in the late 40's/early 50's, debt was 144% of GDP (aka much higher than today). we didn't scream, "OMG debt! cut spending!" instead we grow our way out with economic expansion spurred by a high tax rate and government investment.

of course being the simpleton you are it's easier for you to scream, "OMG really big number" than it is to look at the finer points.Comment -

#586These retards understand all that, they just like pretending they have the same interests a billionaire.

Makes them feel good.

Every poster here pays more tax than any billionaire in the country & they pretend that thay are alright with it ....because they are rich too. Comment

Comment -

#587These retards understand all that, they just like pretending they have the same interests a billionaire.

Makes them feel good.

Every poster here pays more tax than any billionaire in the country & they pretend that thay are alright with it ....because they are rich too.

you make it more and more obvious how uneducated you are about economics and history.Last edited by brooks85; 11-02-15, 01:31 PM.Comment -

#5888.6% isn't exponential? OK. From Reagan to Clinton's second term, I had to change my w2, two times. From getting

money back every year under Reagan, to owing money under Clinton.Comment -

#589rising exponentially as it has been since the 50s. Again, you don't even know our real debt which dwarfs the 20 trillion you keep referencing. Spending has to be cut, your petulant whining does not change the math.Oh IDK, under Clinton taxes were raised exponentially. Where was the debt then?

Since you are a fan, listen closely to Trump's message on taxing. A one time tax on the rich of 10%, taxing wall st

speculators etc. Do you think he will get elected talking like a Dem?

Repubs don't use math. They have this graph or a curve they go by. This graph/ curve depicts the supposed tax income received, by cutting corporate and the rich taxes.

Corporations still left America to go overseas even when their tax rates were reduced. Why do Repubs still try to

push that shit? Another example of failed policies. Trump and Bernie are the only one's talking about bad trade deals.

"Repubs don't use math."

more hypocritical nonsense from a confirmed sheep. That is why you support Obamacare.. because in fact you sheep democrats do not use math.

"They have this graph or a curve they go by. This graph/ curve depicts the supposed tax income received, by cutting corporate and the rich taxes. "

there you go again talking about things you don't know about. Lol what do you think the curve is based on ya fool? Math.

Secondly, there is a known flaw with the Laffer curve and you're going to love this; the Laffer curve assumes the tax revenue collected by the government is spent for the GOOD of the citizen's and SEPARATE from providing "jobs." Oh yeah, how many people are "employed" by the government again?... lol

Good job showing again you don't understand what you're talking about.Comment -

#590Now, why would I think you would agree with anything I say? (and for that matter, me with you)

Of course you will bash any and all truth posted in here. From politifact to wiki and you pick on me for "my truths"?

So, if I pay less in taxes, does that mean you should get paid less? How about other "govt" employees? If I pay less

in taxes, will the defence dept get less money? No? You can bet that big thing you're sitting on, the poor will get less.Comment -

#591they measure this shit moron. mobility has been on the decline since reagan. what you are is linked with what your parents were. we used to be a far more mobile society (pre-reagan when the rich and corporations actually paid their taxes and a living wage and we used that money to make the economy and country stronger).

Nobel laureate and economist Joseph Stiglitz laid out why that ideal has been left behind and what the U.S. can do about it in an opinion piece for the New York Timesthat ran over the weekend. Stiglitz writes that today, the U.S. has less “equality of opportunity” than other advanced industrial nations. This means that poor children have less of an opportunity to be successful than middle and upper-class children. “The life prospects of an American are more dependent on the income and education of his parents than in almost any other advanced country for which there is data,” says Stiglitz.the american dream is now the canadian dream:“After 1980, the poor grew poorer, the middle stagnated, and the top did better and better. Disparities widened between those living in poor localities and those living in rich suburbs — or rich enough to send their kids to private schools,” notes Stiglitz. “A result was a widening gap in educational performance — the achievement gap between rich and poor kids born in 2001 was 30 to 40 percent larger than it was for those born 25 years earlier.” Other forces that fuel America’s inequality include the poor being more exposed to environmental hazards and being less likely to experience enriching activities like music, as well as lacking proper nutrition.

College, too, is part of the problem. Students are faced with crushing loan debt while getting an education remains important to obtaining a job.

So what is to be done? Stiglitz says that without changes to these policies that fuel inequality of opportunity, “the image we project to the world, will diminish — and so will our economic standing and stability. Inequality of outcomes and inequality of opportunity reinforce each other — and contribute to economic weakness.” But there are options to pursue to stop this trend.

Mothers should be able to reduce their exposure to environmental hazards, get prenatal health care and have the option of sending their children to pre-kindergarten education. Access to higher education is also imperative.

“A more educated population yields greater innovation, a robust economy and higher incomes — which mean a higher tax base,” the economist writes. “Those benefits are, of course, why we’ve long been committed to free public education through 12th grade. But while a 12th-grade education might have sufficed a century ago, it doesn’t today. Yet we haven’t adjusted our system to contemporary realities.”

thanks to dumbass republicans GE is moving a wisconsin manufacturing plant to canada over the import export bank thing.

Comment -

-

#593because you haven't said anything true... It is not difficult. You're biased so say crap that isn't true.Now, why would I think you would agree with anything I say? (and for that matter, me with you)

Of course you will bash any and all truth posted in here. From politifact to wiki and you pick on me for "my truths"?

So, if I pay less in taxes, does that mean you should get paid less? How about other "govt" employees? If I pay less

in taxes, will the defence dept get less money? No? You can bet that big thing you're sitting on, the poor will get less.

"So, if I pay less in taxes, does that mean you should get paid less?

No because they are correlated.

"How about other "govt" employees? If I pay less

in taxes, will the defence dept get less money? No? You can bet that big thing you're sitting on, the poor will get less."

you're right there(see). That is why spending has to be cut which means government "employees" are cut. Ridiculous fat like VAWA, who get over $600 million a year, need to go bye-bye. Raising taxes to even 100% will have no real difference unless you cut spending and start fixing entitlements which might not even be possible.Comment -

#594they measure this shit moron. mobility has been on the decline since reagan. what you are is linked with what your parents were. we used to be a far more mobile society (pre-reagan when the rich and corporations actually paid their taxes and a living wage and we used that money to make the economy and country stronger).

the american dream is now the canadian dream:

thanks to dumbass republicans GE is moving a wisconsin manufacturing plant to canada over the import export bank thing.

http://www.wsj.com/articles/ge-to-sh...est-1443449286

"he american dream is now the canadian dream:"

said no one intelligent ever unless they are biased. Oh yeah, new york times.. good source there.

lol complaining about a tool large corporations(you know? those things you hate) have been taking advantage of and small business do not need. Again, you don't know what you're talking about.Comment -

#595Comment

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code