crypto currency discussion

Collapse

X

-

#526Comment -

-

#528I think it's a one time $10 fee to get your shift card and then there are no fees. Here's a link: https://support.coinbase.com/custome...the-shift-card

The card looks like this:

You're right. Most consumers are not going to go through any additional steps beyond the bare minimum to get what they want. But if you are a bitcoin fan it's relatively easy to make payments with bitcoin. It's actually not much different than applying for a new credit card. Request the card and when it comes in the mail start using it.Comment -

-

#530Howdy, Ace, what's shakin'?

Yeah, Bitpay's terrific. You go to their site and they ask how much money you want to put on your card. You enter "$500" or whatever, then it instantly translates that into an amount of BTC to send them, an address to send it to, and a 15 minute clock to get it sent.

They're very fair on pricing: they use the average of the higest bid and highest ask at Bitstamp at the second you hit return. They do charge a small fee -- less than 1% -- but since they use Bitstamp's price, an exchange that usually trades a few bucks higher than most, if you buy your BTC somewhere cheaper, you'll actually MAKE money on the transfer.

In terms of speed, when you first start they require 1 confirmation to credit your card, but after you build up trust -- I don't know the exact formula, but it's probably a combo of a certain amount of transactions exceeding some set dollar amount -- they start crediting your card immediately, with zero confirmations.

If they were a publicly traded company, I'd be buying their stock hand over fist.Comment -

#531Because this way they can actually make money by backing their debit card with BTC instead of with dollars.

For example, if you'd put $1,000 on a debit card from your bank a year ago and hadn't spent any, it might now be worth $1,020 or something, with interest.

But if you'd used that $1,000 to buy BTC to back your debit card a year ago, today that debit card would be worth about $5,750.Last edited by MeanPeopleSuck; 08-09-17, 08:15 PM.Comment -

#532Hey, Dwight, you and I have similar taste in comedies.

Have you ever seen the original, UK version of The Office? It's a little bit different, but still extremely funny: https://thepiratebay.org/torrent/466...nd_Extras_(UK)Comment -

#533Heh, if I had thoughts on NEO, you'd definitely want to fade them.

My lifetime record trading Antshares is, literally, 0-3, so it's safe to say I definitely don't have my finger on that crypto's pulse!Comment -

#534Sounds like a good way to do it. I like my shift card but I'm pretty down on coinbase after the way they handled the fork.Howdy, Ace, what's shakin'?

Yeah, Bitpay's terrific. You go to their site and they ask how much money you want to put on your card. You enter "$500" or whatever, then it instantly translates that into an amount of BTC to send them, an address to send it to, and a 15 minute clock to get it sent.

They're very fair on pricing: they use the average of the higest bid and highest ask at Bitstamp at the second you hit return. They do charge a small fee -- less than 1% -- but since they use Bitstamp's price, an exchange that usually trades a few bucks higher than most, if you buy your BTC somewhere cheaper, you'll actually MAKE money on the transfer.

In terms of speed, when you first start they require 1 confirmation to credit your card, but after you build up trust -- I don't know the exact formula, but it's probably a combo of a certain amount of transactions exceeding some set dollar amount -- they start crediting your card immediately, with zero confirmations.

If they were a publicly traded company, I'd be buying their stock hand over fist.

Out of curiosity have you bought into any of these ICO's? I've only invested in one: Tezos.

I'm also long on Iota and Ripple. And short on Ether. How about you?Comment -

#535zcash starting to shoot back up.Comment -

#536Damn, Ace, you and I think a LOT alike. I'm long Iota and Ripple and I'm an ETH skeptic, too.Sounds like a good way to do it. I like my shift card but I'm pretty down on coinbase after the way they handled the fork.

Out of curiosity have you bought into any of these ICO's? I've only invested in one: Tezos.

I'm also long on Iota and Ripple. And short on Ether. How about you?

On the ethereum front, I have a tidbit of news: ETH goes live at Bitstamp on Aug 17th, so while I believe ETH to be grossly overpriced (Flippening, my ass), I'm still considering buying some as a short term hold, crossing my fingers for a runup, then selling into the hype that often surrounds new listings. But, ya know, crypto makes fools of us all, so that's probably the one thing you can count on NOT happening.....

On ICO's, I've tried twice and failed twice. But a buddy I went to school with roped me into buying some of Cofound.it, more or less against my will. I can't even make out exactly what they do and after a couple conversations with him, I'm pretty sure he can't, either. But he WAS a great weed and other party favors connection back in the day, so I feel a certain comradeship with him.

A Fun, True Story: The F*CK Token. Initial Coin Offerings (ICO's) have gone completely crazy lately. So last month, two waiters in California wrote a 2 page White Paper of garbage, spent $80 designing this web page: http://www.fucktoken.io/, then used those two worthless items to raise $30,000 in 30 minutes for a token they call F*CK, which does absolutely nothing.

When asked what they'd spend the money on, they said it'd already been spent on "administrative costs," which I'm guessing took the form of a month long vacation in Bangkok or Amsterdam or some other important, fact finding destination.

My question is, will there be a 2nd round of F*CK funding and, if so, will it succeed again?Comment -

#537So when the price of those coins crashes...basically they'll have no fukks to give?Damn, Ace, you and I think a LOT alike. I'm long Iota and Ripple and I'm an ETH skeptic, too.

On the ethereum front, I have a tidbit of news: ETH goes live at Bitstamp on Aug 17th, so while I believe ETH to be grossly overpriced (Flippening, my ass), I'm still considering buying some as a short term hold, crossing my fingers for a runup, then selling into the hype that often surrounds new listings. But, ya know, crypto makes fools of us all, so that's probably the one thing you can count on NOT happening.....

On ICO's, I've tried twice and failed twice. But a buddy I went to school with roped me into buying some of Cofound.it, more or less against my will. I can't even make out exactly what they do and after a couple conversations with him, I'm pretty sure he can't, either. But he WAS a great weed and other party favors connection back in the day, so I feel a certain comradeship with him.

A Fun, True Story: The F*CK Token. Initial Coin Offerings (ICO's) have gone completely crazy lately. So last month, two waiters in California wrote a 2 page White Paper of garbage, spent $80 designing this web page: http://www.fucktoken.io/, then used those two worthless items to raise $30,000 in 30 minutes for a token they call F*CK, which does absolutely nothing.

When asked what they'd spend the money on, they said it'd already been spent on "administrative costs," which I'm guessing took the form of a month long vacation in Bangkok or Amsterdam or some other important, fact finding destination.

My question is, will there be a 2nd round of F*CK funding and, if so, will it succeed again?Comment -

-

#539SammyCoins coming Jan 1, 2018Comment -

#540I'll take $500 in SammyCoins please

ETH is a pretty interesting case. I think it has a lot of value but maybe not quite as much as it should. Even though I don't think it should do well, it probably will anyways. The hype around it is huge. South Koreans especially: https://www.forbes.com/sites/elainer.../#711f42976341

As far as F*ck coin goes: Some people are just morons. That's one of the best things about the free market. It weeds out morons. Hilarious story though. If Crypto is like the wild west than ICO's are like West World.

BTC trading at $3430 as I write this...Comment -

#541NEO on a huge run and you get free GAS.Comment -

#542Anybody else in here mine? check out my setup:

Comment -

-

-

#546anybody investing in NEOGAS on binance ??? reading some really good thingsComment -

-

#548https://hacked.com/keeping-neo-charts/It seems that NEO/ANS has had a meteoric rise in the past few weeks, now on its way to $28, maybe testing $30, or maybe already at its peak. Although, “peak” seems unlikely. NEO is billed as the Chinese answer to Ethereum, and Ethereum enjoys a price about 10% of Bitcoin on the regular. If NEO becomes the default cryptocurrency of Chinese projects, on which they build Ethereum-like projects, then it is, of course, easy enough to see a strong and developed response in China garnering a lot of value. Even more than it has now.It’s no exaggeration to say that the whole cryptocurrency market is still very new. Even if you buy in now, on just about anything that is not a scam, long-term, it’s probably going to be worth more than if you had not, although in the short term there are always booms and busts.

It’s clear to see, as well, that troubles with Bitcoin often translate to boom times for other coins. People recently were allowed to dump from Bitcoin Cash back into Bitcoin if they so chose, and so this explains the sharp price increase there. There’s on the other hand a lot of news about NEO coming out of China, and the buzz continues to grow. Unless there is some massive problem with the platform, it would seem that ICOs from Asia will begin launching on this platform and people will have the option to invest in that manner. Before long, services will exist which will move NEO over private platforms like Alibaba for purchases. Such things will mean a vast improvement to the economy for China, and so it is no surprise that the Chinese government are looking to collect taxes using the blockchain. In a way, the Chinese government is much more comfortable in its own skin than our government because it has a less harnessed power. That is why it’s free to utilize a blockchain product if it feels it is a better option, with few hurdles between planning and execution.Comment -

#549Just hit $36.03 at Bittrex.Comment -

#550Up 20% in the last hour.Comment -

#551yup i know , but its not a huge % of GAS you earn... still better then nothing of course

but i mean you can buy NEOGAS on binance seperately to hold ontoComment -

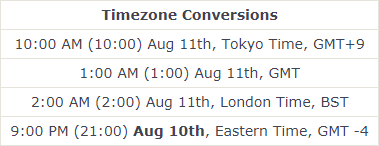

#552https://steemit.com/cryptocurrency/@...today-in-japanLive Stream on YouTube[COLOR=rgba(0, 0, 0, 0.6)]The NEO core team will share with the NEO community enthusiasts in real time via livestream some of the interesting stories and experience.[/COLOR]

The live stream will be available on the NEO YouTube Channel. Don't miss out!!

Comment

The live stream will be available on the NEO YouTube Channel. Don't miss out!!

Comment -

#553Because this way they can actually make money by backing their debit card with BTC instead of with dollars.

For example, if you'd put $1,000 on a debit card from your bank a year ago and hadn't spent any, it might now be worth $1,020 or something, with interest.

But if you'd used that $1,000 to buy BTC to back your debit card a year ago, today that debit card would be worth about $5,750.

consumers don't think like that tho. Majority of people are not that thoughtful to put it kindly. Consumers will still use silver and gold coins for their face value, no joke. It's on youtube. And, for the same reason you're saying they could make money is the same reason bitcoin is not a currency. Currencies do not move like this, they are stable which is why people can count on them. Consumers are not going to take $1000 of something today that could be worth $500 tomorrow and count on it as currency.Last edited by brooks85; 08-11-17, 07:46 AM.Comment -

#554id suggest people here check out OMG coin OmiseGO

it has real world useage and i think itll be big, its blown up this week already and should continue to go up imoComment -

#555OMG has certainly blown up this week. It seems like it is up 50% every day.

Brooks85, You are right. The general public don't think like that. Quite frankly I don't know if they think about this stuff much at all. But for those few that are willing to have foresight and have a desire to be financially independent using btc as your currency is certainly worth the hassle.

I have saved a lot of money just by using bitcoin as my everyday currency.

Over time USD will always slowly and consistently go down in value and bitcoin will do the opposite. The last ten years is pretty good proof.Comment -

#556WTF is going on with BitFinex now?? Restrictions on US individuals starting?Comment -

#557living in ny there are restrictions on most of these exchangesComment -

#558I just logged in last hour to see volume and message popped up saying due to Securities trades in US they are backing away from ICOs and any further US retail customer in coming days. Suspending all moves related to those.Comment -

#559Here it is:

Service Changes for U.S. Customers

August 11, 2017

Bitfinex is making changes to the services we provide to U.S. individuals. These changes impact the verification process and trading of certain digital tokens for U.S. customers. Some changes are effective immediately, and others will be gradually implemented in the coming weeks.

Suspension of U.S. Individual Verification Requests

We regret to announce that, effective immediately, we will no longer be accepting verification requests for U.S. individuals.

We have for some time considered pulling away from the retail marketplace in the U.S., and now with a current backlog of verification requests and ongoing difficulties in providing USD deposit and withdrawals for U.S. individuals, we feel that the time has come to begin disengaging from U.S. retail customers.

Several factors have gone into this decision:

- While we have been able to normalize banking for some corporate customers and individuals in certain jurisdictions, compliant banking solutions for U.S. individuals remain elusive. We have been slowly and selectively inviting users in particular jurisdictions who meet set criteria to start using banking channels that have come online. This process is ongoing.

- A surprisingly small percentage of our revenues come from verified U.S. individual accounts while a dramatically outsized portion of our resources goes into servicing the needs of U.S. individuals, including support, legal and regulatory.

- We anticipate the regulatory landscape to become even more challenging in the future.

- Bitfinex is not based in the United States. Exchanges based in the U.S. are better positioned to properly service retail U.S. customers.

We are thankful to all of our loyal U.S. customers that have consistently traded with us but, unfortunately, we have an obligation to our whole customer base and to our shareholders to make rational resource allocation decisions.

Furthermore, over the next 90 days, we will be discontinuing services to our existing U.S. individual customers. We will be communicating further with affected users on timing and specifics. Our intention is to reduce disruption as much as possible for our U.S. customers.

We will continue to take advice and implement further changes as circumstances warrant.

Restrictions on U.S. Persons Trading Certain Digital Tokens

Pursuant to the recent report of investigation issued by the U.S. Securities and Exchange Commission, Bitfinex is taking the proactive step of barring U.S. customers from trading certain digital tokens that may be deemed securities in the eyes of the SEC.

The restriction will generally apply to ERC20 tokens issued through "ICOs" and will go into effect at noon UTC on Wednesday, August 16, 2017. No trading of these tokens will be allowed for U.S. customers. At the time of this post, the tokens active on Bitfinex that will be subject to this restriction are EOS (EOS) and Santiment (SAN).

Once again, we regret any inconvenience this change in policy might create, but we believe this to be a prudent measure given the regulatory uncertainty surrounding such digital assets.

Comment -

#560Pretty lame. But I get why they are doing it. I wouldn't want to deal with the US government's BS red tape either.Comment

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code