Big food shortage is coming, NTR is one I’ve owned and mentioned before, MOS is another

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

#11551Comment -

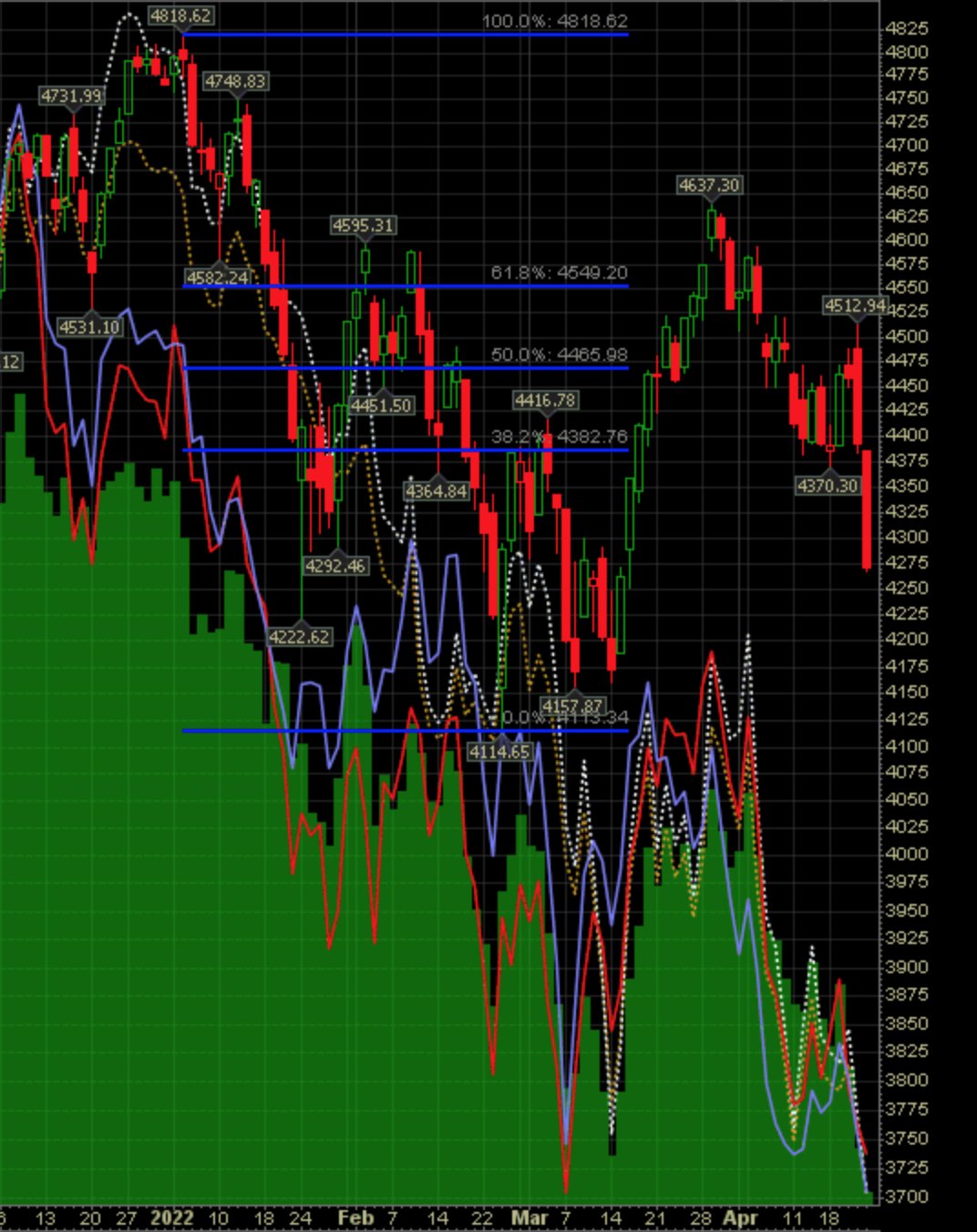

#11552I want to give a quick update to the chart I posted yesterday. Junk bonds have made a new low, as has insider buying and discretionary relative to staples.

Also, we appear to be working on a huge head and shoulders pattern:

Comment -

#11553Good question. That is why I buy best iin class companies. I own ~90 different stocks and ETFs and have them all pretty even amounts. If I DCA three times on a particular position i typically stop and i don't chase.

I typically DCA when a position is down ~40% give or take and then one more time if it goes down ~25% from that last buy point and then I'm done.

Extremely rare for a best in class stock to go BK and even more rare that two I own will. Worst case i lose those two but still have 88 to ride with.Comment -

#11554Ok well that's different, in your initial post that wasn't mentioned I don't think.Good question. That is why I buy best iin class companies. I own ~90 different stocks and ETFs and have them all pretty even amounts. If I DCA three times on a particular position i typically stop and i don't chase.

I typically DCA when a position is down ~40% give or take and then one more time if it goes down ~25% from that last buy point and then I'm done.

Extremely rare for a best in class stock to go BK and even more rare that two I own will. Worst case i lose those two but still have 88 to ride with.Comment -

#11555 Comment

Comment -

#11556So I assume an up week coming next, right?Comment -

#11557Been through the college thing, all my best, in so many ways. My one daughter (Extremely successful) and wife and I came out the other end OK.i live totally within my means. i have a good time and treat my family and myself to nice things but while my buddies all bought tesla's i own two paid off japanese cars and all the money i'd be paying on car payments, goes into the stock market. i do pretty decent salary wise but i don't spend much outside my means. it's all for my kids' futre.

i don't put money in the market i will need within 5 to 7 years. "time in the market beats timing the market".

my stuff from 2020 still way up.

my stuff from 2021 way down.

my stuff from 2021 i was much more conservative with because i knew i was buying much higher than normal.

now the cash on the sidelines moves back in, in the coming weeks and months.

rinse and repeat.

i grade myself in Fall 2030 and 2032 when my kids start college, respectively.

We are both collecting SocSec and doing pretty well living off it and some small 401K supplements. House and cars paid off. Although I have to admit I did buy a few decent cars but almost all CPO's.

You sound like you've you got a great sound footing and strategy. We are happy living a pretty frugal lifestyle, aside from driving decent vehicles, and too many ventures out to eat. Saved a lot there during the pandemic. Bottom line , the prudent lifestyle has paid off for us and sounds like you are on a great path to the same. All my best!

Comment

Saved a lot there during the pandemic. Bottom line , the prudent lifestyle has paid off for us and sounds like you are on a great path to the same. All my best!

Comment -

#11558Hey TRob,

MOS was a nice observation. I'm not sure when you offered (a month or so ago?). I got hung up thinking I was late to the party after viewing the chart. Do you think this has more room to run after the small dip?Comment -

#11559I know this is kind of outside your model, but I do have a few longer view speculative plays. I bought small dip into symbol DNA for my grandkids. Futuristic stuff but they have some pretty influential investors and some pretty interesting collaborations recently.i live totally within my means. i have a good time and treat my family and myself to nice things but while my buddies all bought tesla's i own two paid off japanese cars and all the money i'd be paying on car payments, goes into the stock market. i do pretty decent salary wise but i don't spend much outside my means. it's all for my kids' futre.

i don't put money in the market i will need within 5 to 7 years. "time in the market beats timing the market".

my stuff from 2020 still way up.

my stuff from 2021 way down.

my stuff from 2021 i was much more conservative with because i knew i was buying much higher than normal.

now the cash on the sidelines moves back in, in the coming weeks and months.

rinse and repeat.

i grade myself in Fall 2030 and 2032 when my kids start college, respectively.Comment -

#11560Sorry thought I published this here but apparently I didn’t, it’s from Nov 2021:

Royalty Companies: I was able to do a some research on royalty companies and will discuss below. My reasons and overall thesis for owning a royalty company at this point is really as a hedge for inflation or if you feel inflation will be sticky, then investing a sizable chuck. Inflation, like any other asset, compounds until you have a snowball effect of hyperinflation...so, keeping this in the back of my mind, I think it’s prudent to start understanding how you will manage this situation IF it occurs. To be clear, I do not think Fed will allow this to happen, and, the bond market doesn’t seem to think inflation is sticky either.

Royalty companies are great during inflation because, they get paid no matter how prices adjust. Usually these are companies who seed fund start ups, research or provide liquidity with intent the profits are returned as royalties. So, if the company paying the royalty endures increased inflation costs, they still must pay the same royalty fee. The company receiving royalty still gets paid without any changes to their operating expenses normally incurred during inflation.

To chose which Royalty companies I would consider investing, I used the following criteria:1) Sector: do the businesses paying royalties usually withstand inflation? These tend to be basic materials/iron, steel, energy/utilities, ie oil, gas, uranium!, land/real estate ie REITs, healthcare & other essential/consumer staples. 2) Growing revenue: is the royalty company making money, or have a runway for future revenue growth ie increased demand. 3) Insider/Institutional money: Have insiders been piling in or major hedgies buying new positions.

#1 Texas Pacific Land Corphttps://d1io3yog0oux5.cloudfront.net/_c24dedf5c8fc91062fc9c546bbe207f0/texaspacific/db/706/6041/pdf/TPL+Investor+Presentation+June+2021.pdf

# Nutrien https://nutrien-prod-asset.s3.us-eas...r_9_2021_0.pdf

#3 Royalty Pharma https://www.royaltypharma.com/static...e-a559bf7f646a

TLDR; In a liquidity crises, which...cue the Phil Collins... I can feel it comin...there will be a flight to safety like nothing you’ve ever seen...royalties are the quintessential poster child of flee to safety...TPL: Land, Oil, Water, Permian Basian, insider buying like he owes someone money...revenue only dipped because of Covid and demand is surging...Texas is becoming the Saudi Arabia of the World, not only Oil but also Solar and Crypto Mining.

NTR: You are likely unfamiliar, I was prior to last week. This company allows is singularly the most important company to grow anything in the US, they repurchased a zillion shares and revenue is up only.

RPRX: pharmaceutical company strictly based on royalty income, and they have some big names after reviewing their pipeline, also a dividend, revenue grew even throughout Covid, Berkshire just bought a bag, only drawback I see is insiders sold, but they just IPO’d and these were likely seed money looking to cash in after over a decade.Comment -

#11561Brother, I work 50 hrs a week, am married, two kids, doing HW with them, coaching their football and softball teams, i have like no time LOL

i only expound if i am asked, plus i'm not terribly good at the stock stuff so who i am to dole out advice to anyone LOL

everyone has their style and what suits them and their goals. for me, i just cannot handle the market timing (or attempt to) in and out trying to buy low and sell high so i just keep cash available and stay in positions long, so i can catch falling knives whenever i need to but i have heavy duty protective gloves made out of the perfect material to neutralize the knife blades as much as possible.

of course, that has not worked out on doozies like these where i am way down:

- NFLX

- RBLX

- SHOP

- PLUG

etc etc

i need to figure out which ones i will Average Down on and which ones i will simply stand and do nothing.

i am Not selling these. since i am long, why not give them a chance to come back some day?Comment -

#11562Madison, Continued good health to You and Yours, my manBeen through the college thing, all my best, in so many ways. My one daughter (Extremely successful) and wife and I came out the other end OK.

We are both collecting SocSec and doing pretty well living off it and some small 401K supplements. House and cars paid off. Although I have to admit I did buy a few decent cars but almost all CPO's.

You sound like you've you got a great sound footing and strategy. We are happy living a pretty frugal lifestyle, aside from driving decent vehicles, and too many ventures out to eat. Saved a lot there during the pandemic. Bottom line , the prudent lifestyle has paid off for us and sounds like you are on a great path to the same. All my best!

Saved a lot there during the pandemic. Bottom line , the prudent lifestyle has paid off for us and sounds like you are on a great path to the same. All my best! Comment

Comment -

#11563I see the debate over day trading, swing trading, buy and holders, add on the dippers, and the buy allot of cheap speculators. I have to say I do all of the above. It takes discipline and knowledge for each. For instance, Earlier this week, I put up 15 dimes on that train wreck NFLX as a day trade. Lost a quick $1000 and took my losses. I make maybe 10 such falling knife trades, or as I call them, spring theory trades every week. On average those hit about 75% of the time where I will pick up a quick grand. It looks like a risky trade, but there is allot of analysis that goes with it.

Same goes with my add every month stocks, AU, and GDX. If been buying $100 worth of both of these every month for probably 10 years now. That system works so long as you pick a company that you think has a very high stability factor.

The bottom line is that in this game, you get to pick when the game starts and ends. If you have a great game plan to begin with and you stick to it. It will reward you.Comment -

#11564You can't fight the market on the way up or down.

Rates up. Market will go down.

Rates down. Market will go up.Comment -

#11565You get out if SE?Brother, I work 50 hrs a week, am married, two kids, doing HW with them, coaching their football and softball teams, i have like no time LOL

i only expound if i am asked, plus i'm not terribly good at the stock stuff so who i am to dole out advice to anyone LOL

everyone has their style and what suits them and their goals. for me, i just cannot handle the market timing (or attempt to) in and out trying to buy low and sell high so i just keep cash available and stay in positions long, so i can catch falling knives whenever i need to but i have heavy duty protective gloves made out of the perfect material to neutralize the knife blades as much as possible.

of course, that has not worked out on doozies like these where i am way down:

- NFLX

- RBLX

- SHOP

- PLUG

etc etc

i need to figure out which ones i will Average Down on and which ones i will simply stand and do nothing.

i am Not selling these. since i am long, why not give them a chance to come back some day?Comment -

#11566OK here we go with another fun filled week of stock trading. The SPY is right at support $426ish. This is a buy level here for me for another one of those day / swing trades. I think the markets are gonna try to rally the tape here early in the week, but the bears may be lurking to push even lower. So hopefully the futures don't run the tape up before the bell Monday, as I look at the futures, they are down slightly on Sunday night. Its pretty easy though, if they can't hold $426 on hourly closes tomorrow. They will run it down to the $416 spot before I will try buying again. On the upside, they will need to get to $432.75 and hold it before I even start to think the rescue operation is in play. Otherwise I'll be on the PUT train to lower prices.

How about that Nasdaq you ask?

Well all the markets are the same. They ran this one right down to support as well, close to $325ish. Only difference is this one is close to the low for the year at $317.45, and if it can't hold $325 on hourly closes Monday, you can bet those PUTs that a test of the $317.50 spot will be on the table. For a rally situation, the price will need to get to and hold $332 on hourly candle closes, which is a gap from about a month ago. It ain't much to look for but that is the minimum price I will even entertain an ambulance showing up for the thought of helping this thing out. The Nasdaq is leaking some blood here and if some things break just right, it could make the market go down with it. I think the Calvary shows up. There will be some BS news that will help out this week. Its either that or we are looking at another dump operation.

Looking at the SPY 3 Year chart with monthly closes, (yeah I zoomed in a little so we don't get the full 3 year look), you can see what I call the I-Beam of Bull Shit pattern. The people who control and manipulate the market are doing all they can to hold the SPY up above the 20MMA. I suspect they will do it again for this month, but the more the 20 MMA is tested the easier it is to break through one day and the fall will be pretty steep. Ironically I see support at the 360 spot which is right around that spot GuitarJosh has pinpointed as the head and shoulders support level.

Over on the QQQ side the I-Beam of bullshit is set up at a different spot. They have been lower than the 20 Month moving average the last 3 of the 4 months but not closing lower, so with the increase of crossing back and forth over a moving average, the less important that moving average is, and back in Jan, price pretty much bounced off of that level. Since then it has been above and below several times. As you can see the $325 level is the spot for this I-beam, and under that I see a final support level at $297. This is close enough to the nice simple number of $300, so I'll call that spot the look out below number. If the monthly close gets to and closes below this number, next stop will be the $255 spot of the 50 MMA unless they come up with a goal line defense.

Last edited by Slurry Pumper; 04-24-22, 06:31 PM.Comment

Last edited by Slurry Pumper; 04-24-22, 06:31 PM.Comment -

#11567I would say you have your hands full. (so to speak). I was in a similar situation. Would not change a thing. I agree with your stance 100%..Brother, I work 50 hrs a week, am married, two kids, doing HW with them, coaching their football and softball teams, i have like no time LOL

i only expound if i am asked, plus i'm not terribly good at the stock stuff so who i am to dole out advice to anyone LOL

everyone has their style and what suits them and their goals. for me, i just cannot handle the market timing (or attempt to) in and out trying to buy low and sell high so i just keep cash available and stay in positions long, so i can catch falling knives whenever i need to but i have heavy duty protective gloves made out of the perfect material to neutralize the knife blades as much as possible.

of course, that has not worked out on doozies like these where i am way down:

- NFLX

- RBLX

- SHOP

- PLUG

etc etc

i need to figure out which ones i will Average Down on and which ones i will simply stand and do nothing.

i am Not selling these. since i am long, why not give them a chance to come back some day?

My 401K was spectacular and have not one regret. When I was younger, I was investing conservatively. One day my boss, (friend) told me I should get aggressive at my age. My early 30's. He was close to 50.. I listened to him and never looked back.

I went to higher dividend stocks and took some shots here and there as I got older.

Just saying. Once I gained confidence, it became even easier. I never went '' all in ''. so to speak.

Patience is a virtue and you will win out in the end by having it. The stock market has always been one of the best tools, along with Social Security for retirement. You will get there, I'm sure. Sounds to me like your secure and stable. Family first, everything else comes after...

GL going forward ..Comment -

-

#11569Slewer, thank you for your post.I would say you have your hands full. (so to speak). I was in a similar situation. Would not change a thing. I agree with your stance 100%..

My 401K was spectacular and have not one regret. When I was younger, I was investing conservatively. One day my boss, (friend) told me I should get aggressive at my age. My early 30's. He was close to 50.. I listened to him and never looked back.

I went to higher dividend stocks and took some shots here and there as I got older.

Just saying. Once I gained confidence, it became even easier. I never went '' all in ''. so to speak.

Patience is a virtue and you will win out in the end by having it. The stock market has always been one of the best tools, along with Social Security for retirement. You will get there, I'm sure. Sounds to me like your secure and stable. Family first, everything else comes after...

GL going forward ..

I also have my accounts set up on DRIP so i am reinvesting all dividends.

I am playing the long game.Comment -

#11570Divi renivesting is most certainly dollar cost averaging.

Comment

Comment -

#11571Proctor and gamble is very good when shit is badSorry thought I published this here but apparently I didn’t, it’s from Nov 2021:

Royalty Companies: I was able to do a some research on royalty companies and will discuss below. My reasons and overall thesis for owning a royalty company at this point is really as a hedge for inflation or if you feel inflation will be sticky, then investing a sizable chuck. Inflation, like any other asset, compounds until you have a snowball effect of hyperinflation...so, keeping this in the back of my mind, I think it’s prudent to start understanding how you will manage this situation IF it occurs. To be clear, I do not think Fed will allow this to happen, and, the bond market doesn’t seem to think inflation is sticky either.

Royalty companies are great during inflation because, they get paid no matter how prices adjust. Usually these are companies who seed fund start ups, research or provide liquidity with intent the profits are returned as royalties. So, if the company paying the royalty endures increased inflation costs, they still must pay the same royalty fee. The company receiving royalty still gets paid without any changes to their operating expenses normally incurred during inflation.

To chose which Royalty companies I would consider investing, I used the following criteria:1) Sector: do the businesses paying royalties usually withstand inflation? These tend to be basic materials/iron, steel, energy/utilities, ie oil, gas, uranium!, land/real estate ie REITs, healthcare & other essential/consumer staples. 2) Growing revenue: is the royalty company making money, or have a runway for future revenue growth ie increased demand. 3) Insider/Institutional money: Have insiders been piling in or major hedgies buying new positions.

#1 Texas Pacific Land Corphttps://d1io3yog0oux5.cloudfront.net/_c24dedf5c8fc91062fc9c546bbe207f0/texaspacific/db/706/6041/pdf/TPL+Investor+Presentation+June+2021.pdf

# Nutrien https://nutrien-prod-asset.s3.us-eas...r_9_2021_0.pdf

#3 Royalty Pharma https://www.royaltypharma.com/static...e-a559bf7f646a

TLDR; In a liquidity crises, which...cue the Phil Collins... I can feel it comin...there will be a flight to safety like nothing you’ve ever seen...royalties are the quintessential poster child of flee to safety...TPL: Land, Oil, Water, Permian Basian, insider buying like he owes someone money...revenue only dipped because of Covid and demand is surging...Texas is becoming the Saudi Arabia of the World, not only Oil but also Solar and Crypto Mining.

NTR: You are likely unfamiliar, I was prior to last week. This company allows is singularly the most important company to grow anything in the US, they repurchased a zillion shares and revenue is up only.

RPRX: pharmaceutical company strictly based on royalty income, and they have some big names after reviewing their pipeline, also a dividend, revenue grew even throughout Covid, Berkshire just bought a bag, only drawback I see is insiders sold, but they just IPO’d and these were likely seed money looking to cash in after over a decade.Comment -

#11572They're killing it going into the open. The bulls need to get back to Friday's close to start with, the Bears want to go test the $416 on the SPY, and the $317.50 point on the QQQs like I mentioned just last night. Could be ugly again today if the bears win out. I think the ambulance shows up here eventually and a out of nowhere for no real reason, there will be a blow your hair back rally.

Gold getting hammered early today puts my favorite mining stocks in the Spring theory day trade scenario. Since they are also my add to every month stocks, its a two for. I get to buy lower than I thought I would be able to and a spring theory bounce. This commodity sell off lately will be short lived and we will get back to the march up da hill soon enough.Comment -

#11573and KVer when i am down ~40% on my initial entry point into a position (i try to assess market conditions and if i believe minus ~30% or whatever is the time to buy more, i will), i often times add more to my position if not simply double it up buy ordering the exact number of shares i already own.

that is the biggest way i DCA for sure, but the DRIP helps a little too, though I cannot control what price i am buying shares at on that :-)Comment -

#11574Looks like Twitter is sold.Comment -

#11575They are trying to bounce the market here at 420. I can see the story now about how the twitter moved the market. The I beam of bullshit must be built or things get real bad real quick.Comment -

#11576That’s why it’s DCA, buying at set intervals, at divi time.and KVer when i am down ~40% on my initial entry point into a position (i try to assess market conditions and if i believe minus ~30% or whatever is the time to buy more, i will), i often times add more to my position if not simply double it up buy ordering the exact number of shares i already own.

that is the biggest way i DCA for sure, but the DRIP helps a little too, though I cannot control what price i am buying shares at on that :-)

When the market moves, and you are reassessing whether to buy more, that’s a bit more like market timing. Of course, with what you’re doing is a little more to it, because you looking to nip away as it goes down X percent...creating a DCA like interval.

I think you have a good outlook, understand what you’re trying to do, and are executing it.

You simply can’t ask for more than that, whatever the strategy.

Seeing predictable red today, how about this week?

I need to manage my time a little better, been caught up in SBR quite a bit.Comment -

#11577Under the "Every Dog finds a bone" I bought in (posted) about 6 weeks ago circa 104. Soared to ~120 and I took my $ and ran. I do not totally understand this stock and am very careful with Asia/China shares. A year ago I sold my shares circa 170 and was sick as it soared higher. Would always appreciate any further insight anyone might offer. All my best.Comment -

#11578I put some safety?? money into SLV and GLD. Not getting hurt to bad, but shouldn't these be steady at the least given the recent market declines. I thought these would be a contrarian play to a falling market??They're killing it going into the open. The bulls need to get back to Friday's close to start with, the Bears want to go test the $416 on the SPY, and the $317.50 point on the QQQs like I mentioned just last night. Could be ugly again today if the bears win out. I think the ambulance shows up here eventually and a out of nowhere for no real reason, there will be a blow your hair back rally.

Gold getting hammered early today puts my favorite mining stocks in the Spring theory day trade scenario. Since they are also my add to every month stocks, its a two for. I get to buy lower than I thought I would be able to and a spring theory bounce. This commodity sell off lately will be short lived and we will get back to the march up da hill soon enough.Comment -

#11579Lithium

Great buying opportunity as they've been thrown out with the bathwater of this downturn. LAC a great one to start with. Insiders selling ~ 38-40, which I followed suit to circa 25% of my shares. Buying back in now. My other Lithium shares have been previously posted. Think a very good entry point.Comment -

#11580Yeah the metals are taking a beating. I don't think it will last however. Typically the metals go down with the rest of the market. Well atleast a little bit anyway. Then they roar back once people figure out the inflationary numbers aren't going to subside.Comment -

#11581Thx bud. Always appreciated!Comment -

#11582I think the metals took a beating because of the COVID situation in China. Now cases are surging in the capital Beijing. People there are panic buying stuff, so if another massive chinese city goes under lockdown there will be less demand for metal. The crazy thing is there is no end in sight for these lockdowns in China. Some say it could last until August, which is when the chinese communist party meeting.Comment -

#11583Good point there Enkhbat, China locking down will certainly have an effect for not only the metals but for just about everything out there.

Yesterday, the SPY continued to drop until we got our relief rally started at around 420 with the Twitter news. The day ended with the bulls able to get above what I call the pivot they need to hold here which is $426.50ish. This morning we have a pullback to what level? Yeah you guessed it $426.50. That is the spot they need to hold or we go back down. The ambulance is on the scene but the victim is still laying on the ground and it could go either way. For the bull case, like I stated yesterday the number is up to and at least holding $432ish. Until such time it is a bear's ball type of game. Yesterday the bull defense came out to play and I just lost my co-cat of 14 years so I wont say that term used for this rally but unless they can move above $432, the markets in general are in extreme pressure and the low of the year could be in jeopardy.

How about gold? Well it came down to support at 1900, but it was a panic selling type of gig. That tells me people needed liquidity for something else. Oil took a dump as well, and with those 2 I think the overall market is going to make a big move and that move is down. I'll be picking up PUTS for the 3 month duration here and sticking with them until the SPY gets above $432. Yeah, I bought some weekly Calls yesterday, but that is just very short term stuff here. The market manipulators will need to continue to hold up this thing to avoid a crash scenario and it is getting tougher everyday.Comment -

#11584Hey guys, can someone explain the tritter buyout that Elon is doing. Is he going to pay all stock holders 54 a share? I'm trying to understand how it impacts my existing shares.Comment -

#11585On the day of the sale you'll get 54.20 for each one you own. Or, before the sale you can trade those stocks for the market price. They will make a date to stop trades at some point, and the price should hover around the sale price that elon made.Comment

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code