Yeah, i don't comment much on here, do have a sizable Ameritrade account and think this coming week with Apple and Amazon reporting earnings they will need to justify high valuations, the stimulus proposals, the Feds meeting and also the first reading of the GDP will be released on Thursday. You best be alert all week..jmo.

Stock Market Discussion -- started 03/06/2018 -- updated daily !!!

Collapse

X

-

#6686Comment -

#6687yes Sir but since i'm long term i don't react too much to the volatility unless it is an oppty to add to some positions or to open new ones. most of us in here will be watching very closely thoughYeah, i don't comment much on here, do have a sizable Ameritrade account and think this coming week with Apple and Amazon reporting earnings they will need to justify high valuations, the stimulus proposals, the Feds meeting and also the first reading of the GDP will be released on Thursday. You best be alert all week..jmo.Comment -

#6688Dollar/Bitcoin issue is more about dollar weakness generally than true strength in Bitcoin.

Bitcoin very close to 10k today, however -- 10k is NOT technically important right now.

Comment

Comment -

#6689Yepper looking at the chart above, I see the dollar putting up a little fight in the near term which will spell a little pullback in the gold that I am accumulating. Think I'll tighten up the stop losses for the gold stocks and if it pulls back, it will probably be just a 1st level Fibonacci play before I jump back in just in time for that stimulus to pull down the dollar again.

This will also give Silver a chance to pull back so I can load up on some SLV.Comment -

#6690Buy the fookin dip

MSFT -long and strong

CRWD -mid to long

Inseego -mid to long

Insights

OPK Opko health; contract to perform all the covid testing on all 32 NFL teams. This already had a 100% run up from 2.5 to 5. Sounds like the NFL and PA have come to a deal...this is risky but at 5.28 I’m gonna throw a few 500-1000 at it and see what happens. If the NFL gets cancelled it’s gonna suck regardless. But if they play the Pr on this one could drive it up further. Float on this isn’t great but I think could still pop another 100-200% on good nfl news....thoughts?

Chinese stocks looking very interesting at these prices are KC, BILI, BIDU & YY but, waiting to see how current tensions play out. If Alibaba hits 230 I’d divert to BABALast edited by trobin31; 07-26-20, 09:09 PM.Comment -

#6691Forgot Square, yeah, just buy Square, you won’t regret itComment -

#6692Quick list of Spacs and IPOs in watching

SSSS mentioned this multiple times before, but this is backdoor capital investors in Palantir, set to IPO probably one of of the biggest ever. There has been no dips even with the recent pullback. Been adding since 10 and will keep adding.

NFIN spac into tritteras/kratos, a huge fintech company, been pretty flat at $10 as no deal firm spac deal yet.

graf spac play into vldr, nice dip buy in opportunity here.

LCA > golden nugget; nice dip to buy into, I bought more at 12.6 last week and if goes down further just add more. Pretty simple.Comment -

#6693Everyone is talking about what the next thing is.

The next thing is 5g. It's not going to be this year, next year, or the one after. But soon, we will start talking on facetime via holograms courtesy of 5g. We will start signing contracts as holograms.

Cable TV networks are going to get buried if they don't adapt and change pricing too

5g will allow you to download a full movie in 30 seconds

Even tho the tech exists, there are far too many complications right now to get the full benefit of 5g.Cause Sleep is the Cousin of DeathComment -

#6694Yeah, seriously! You know what SBR should do... given the considerable size and activity of this thread, there’s clearly interest in the markets by posters here, enough to warrant a sub forum perhaps? Maybe make it a “stock market and bitcoin trading” sub forum?Comment -

#6695Yeah, I’ve had a small position in Graf for a bit, thinking of jumping into LCA if it dips any more.Quick list of Spacs and IPOs in watching

SSSS mentioned this multiple times before, but this is backdoor capital investors in Palantir, set to IPO probably one of of the biggest ever. There has been no dips even with the recent pullback. Been adding since 10 and will keep adding.

NFIN spac into tritteras/kratos, a huge fintech company, been pretty flat at $10 as no deal firm spac deal yet.

graf spac play into vldr, nice dip buy in opportunity here.

LCA > golden nugget; nice dip to buy into, I bought more at 12.6 last week and if goes down further just add more. Pretty simple.Comment -

#6696Here are my 5G investmentsEveryone is talking about what the next thing is.

The next thing is 5g. It's not going to be this year, next year, or the one after. But soon, we will start talking on facetime via holograms courtesy of 5g. We will start signing contracts as holograms.

Cable TV networks are going to get buried if they don't adapt and change pricing too

5g will allow you to download a full movie in 30 seconds

Even tho the tech exists, there are far too many complications right now to get the full benefit of 5g.

PLDs: Inseego buy anything <10

Software: Xilinx <98

Backhaul: Ceragon <2.6

Chips: I dca fractional shares into NVDA and ASML for retirement acct anyway

Towers:Crown castle <162

some of the biggest winners from 5G and the next several iterations of higher speed will be AI and robotics so consider that another reason to own Tesla but ARK has an AI etf and also BOTZ. Take a look at their holdings to get a good idea where the smart money is.Last edited by trobin31; 07-27-20, 06:27 AM.Comment -

#6697Slurry when do you think there will be a gold correction?Yepper looking at the chart above, I see the dollar putting up a little fight in the near term which will spell a little pullback in the gold that I am accumulating. Think I'll tighten up the stop losses for the gold stocks and if it pulls back, it will probably be just a 1st level Fibonacci play before I jump back in just in time for that stimulus to pull down the dollar again.

This will also give Silver a chance to pull back so I can load up on some SLV.Comment -

#6698Saddle up people this should be a big market moving week with all the stuff that is going to be reported.

Gold is going through the roof, yay! Still expected a pullback soon however unless tensions with China get hotter and the dollar just tanks under nearby support. Tight stops to lock profit in, then after the pullback its back to the rocket ride for the next 6 months.

I'm also liking the energy sectors, and some other beaten down sectors like financials, and cruise ships (who the hell wants to float around on these floating virus experiments?).Comment -

#6699Gold is in a long term bull ride but in the short term it will need to pause a little. I think this week was the week, then I woke up this morning to gold rising another 30 bucks. I still think it pulls back this week after it hits the all time high. Probably coming back to 1850 or so before getting steam for $2100.Comment -

#6700tech running back up before the big reporting this week of some monstersComment -

-

#6702made a fortune on swks. they will do much in 5g field pairing with aaplEveryone is talking about what the next thing is.

The next thing is 5g. It's not going to be this year, next year, or the one after. But soon, we will start talking on facetime via holograms courtesy of 5g. We will start signing contracts as holograms.

Cable TV networks are going to get buried if they don't adapt and change pricing too

5g will allow you to download a full movie in 30 seconds

Even tho the tech exists, there are far too many complications right now to get the full benefit of 5g.Comment -

#6703should of sold fb at 247 and rebought at 232. never seem to time them yetComment -

#6704good move by nkla today up 4nkla at around 30 seems good... like when bynd went back down to 60 after the post-ipo run up... same kind of action, open up then triple then back down to the ipo/spac price

can't think of much else that looks good at current levels, the retail/hotel/casino stuff that i follow is probably fairly priced at this point

dkng getting smacked around with the mlb cancellations... i grabbed some september 30 puts at a pretty good priceComment -

#6705Comment -

#6706DKNG .... I hate to say I told you so, but ...

Been busy but heard news about Marlins and now the team they just played. Apparently 12 Marlins positive? Talking head suggesting they may consider canceling season? If there was one sport I thought was least likely it was baseball. Will not be surprised if NBA next where there is way more contact.

DKNG up ~2 premarket and now down ~4.Comment -

#6707DKNG and GAN have killed me the last week. So has SE, SQ, and FSLY. Just pulled out of everything today. Taking the week off and re-assessing next week. I could be losing $$$, true, but I also could be saving. It’s been a sea of red for a week now and I’ve got too many other things to worry about than the stock market right now. If I see a can’t miss opp, I may play, but chances are I’ll be sitting out this week.

I’m worried about the fighting over the stimulus package this week hurting the economy. Also worried about AAPL’s drop and the feud we have with China. That’s not even to mention the COvID-19 mess.Comment -

#6708I certainly have some chip exposure, but mostly been looking at infrastructure.Here are my 5G investments

PLDs: Inseego buy anything <10

Software: Xilinx <98

Backhaul: Ceragon <2.6

Chips: I dca fractional shares into NVDA and ASML for retirement acct anyway

Towers:Crown castle <162

some of the biggest winners from 5G and the next several iterations of higher speed will be AI and robotics so consider that another reason to own Tesla but ARK has an AI etf and also BOTZ. Take a look at their holdings to get a good idea where the smart money is.

CCI/AMT cell towers.

Looked at Blink this weekend but concerned I'm late to the party??Comment -

#6709I am heavy ASML & NVDA non-fractional. Took a nice hit Thu/Fri last week though.Here are my 5G investments

PLDs: Inseego buy anything <10

Software: Xilinx <98

Backhaul: Ceragon <2.6

Chips: I dca fractional shares into NVDA and ASML for retirement acct anyway

Towers:Crown castle <162

some of the biggest winners from 5G and the next several iterations of higher speed will be AI and robotics so consider that another reason to own Tesla but ARK has an AI etf and also BOTZ. Take a look at their holdings to get a good idea where the smart money is.Comment -

-

#6711flipped a MS call earlier, nice gain off low.

looking at SBUX as technical short before earnings.

Ceasars likely to drop more 24/26

avoid casinos --- too much bad virus news may mean slower reopen plans.

banks ok, materials ok, tech is a trap, precious metals likely to be stamped down in a week or so

by the Fed desk, unless UUP breaks under 25 - watch UUP to see 25 then if it holds, gold and silver will sell off.

If UUP starts going under 25 then we're in a really new paradigm where the Fed is no longer defending its currency.Comment -

#6712Snower GL on shorting SBUX. I am long on them and MCD in the food space.

in other news, tech is so resilient, it is great to see

QQQ to the moon !!Comment -

#6713Couldn't agree more with you regarding the metals and the dollar. I don't think the FED will defend the dollar with any vigor. Yeah maybe a blip on the chart for a little bit, but the momentum of downward pressure on the dollar is really built up and with the stimulus building to higher and higher amounts and expectations, I can only seeing the dollar decreasing further.flipped a MS call earlier, nice gain off low.

looking at SBUX as technical short before earnings.

Ceasars likely to drop more 24/26

avoid casinos --- too much bad virus news may mean slower reopen plans.

banks ok, materials ok, tech is a trap, precious metals likely to be stamped down in a week or so

by the Fed desk, unless UUP breaks under 25 - watch UUP to see 25 then if it holds, gold and silver will sell off.

If UUP starts going under 25 then we're in a really new paradigm where the Fed is no longer defending its currency.

I don't like the SBUX trade even with the technicals being favorable, that is a favorite company of the millennials and caffine crowd who will be looking for a FANGless stock to jump into.Comment -

#6714Did the gov't really just give Monderna nearly half a billion dollars?

JFCComment -

#6715Just wanted to mention this again if anyone’s curious, if you are looking for a binary play, $ITCI (biotech/pharmaceutical company) is going to be releasing some either very very good or very very bad (will be impactful no matter what) data regarding their newly approved drug (lumapeterone aka Caplyta) any day now. More than likely prior to Aug 21 options date 75% chance IMO prior to then) and 99% prior to September options date. When caplyta was approved in December it tripled in value overnight. I have 75% of my current portfolio in $ITCI so I am insanely bullish on them long term and give the data drop even odds to be good.

The data would allow them to expand the indications for the drug to include bipolar II or if the data is not good, put a huge damper on that happening, which is a market worth hundreds of millions of dollars. Check them out.

Also bullish on $SQ $AMD (wait for a dip with amd) and for a contrarian play, I’m also bullish on $PDD.Comment -

#6716I said I would buy if I saw a good opp...I found one. In at 0.70 with BKYI. Let it fly.Comment -

#6717Pumper from your mouth to the Stock Universe's earsCouldn't agree more with you regarding the metals and the dollar. I don't think the FED will defend the dollar with any vigor. Yeah maybe a blip on the chart for a little bit, but the momentum of downward pressure on the dollar is really built up and with the stimulus building to higher and higher amounts and expectations, I can only seeing the dollar decreasing further.

I don't like the SBUX trade even with the technicals being favorable, that is a favorite company of the millennials and caffine crowd who will be looking for a FANGless stock to jump into.Comment -

#6718

Field goal time, let's see if we can score!

You can find a lot of stocks showing the same pattern!Comment -

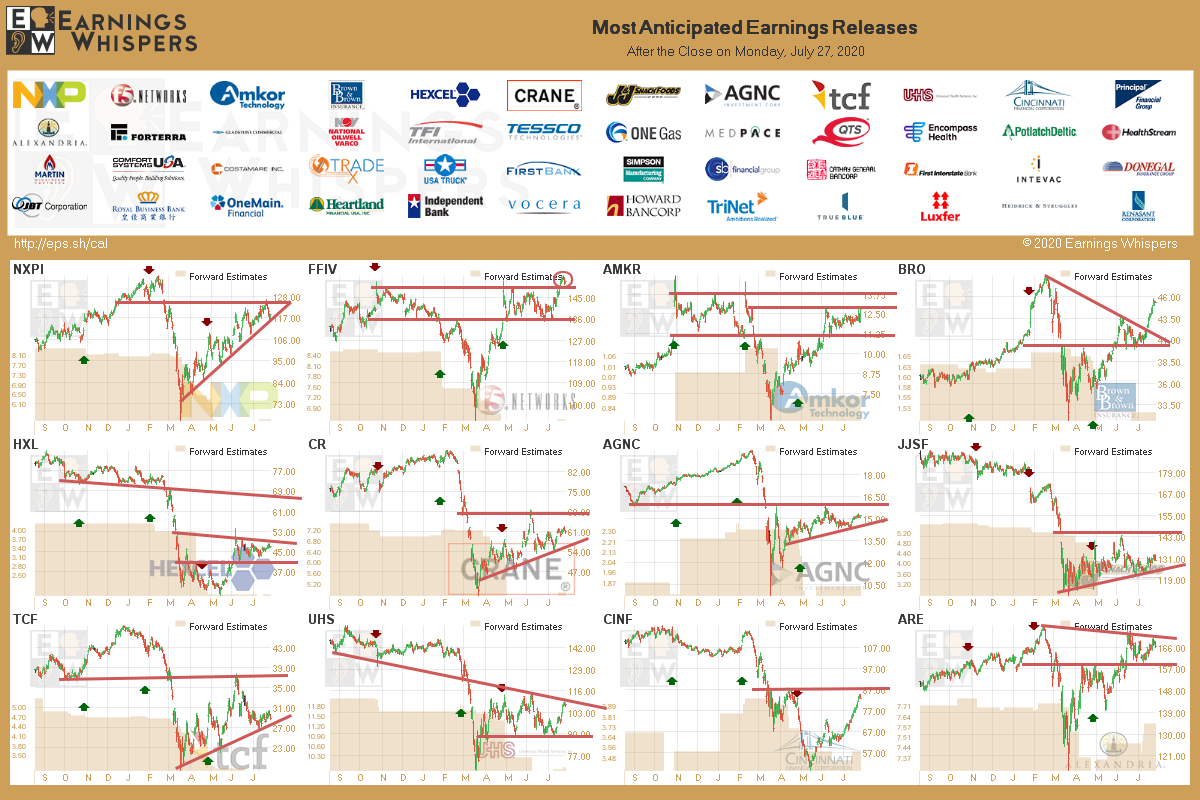

#6719Earning before the bell tomorrow morning:

Comment -

#6720so far gates and fauci have gotten somewhere around $10 billion in free money from the us govt for saying we need to lock everything down until we have vaccine(s)

but no, there's no conspiracy, those guys are total humanitarians

even in 1981 everyone knew dr fauci was a murdering scumbag

Comment

Comment

SBR Contests

Collapse

Top-Rated US Sportsbooks

Collapse

#1 BetMGM

4.8/5 BetMGM Bonus Code

#2 FanDuel

4.8/5 FanDuel Promo Code

#3 Caesars

4.8/5 Caesars Promo Code

#4 DraftKings

4.7/5 DraftKings Promo Code

#5 Fanatics

#6 bet365

4.7/5 bet365 Bonus Code

#7 Hard Rock

4.1/5 Hard Rock Bet Promo Code

#8 BetRivers

4.1/5 BetRivers Bonus Code