I've only ever bet through a local, but I have a Wimbledon play that I'm looking to put a big bet on. My local will only take $1k action on it, and I'm looking to put $8k total. I live in NY so there is now a Draftkings sportsbook inside of a casino near me.

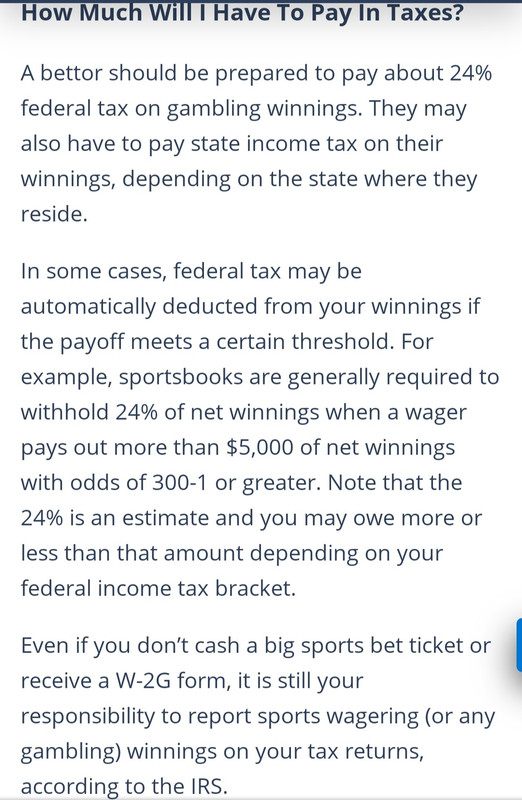

Let's say for example it's Medvedev at +600. If I put $7k on Medevedev to win at the casino, will they make me fill out an IRS form if/when I cash the ticket? I know they do this for a minimum win of $1,200 if you hit a slot or something like that, but I have no idea how it would work with a sports wager. Is there a minimum win where they make you fill out a form?

If this is the case and they will give me an IRS form to fill out, what would happen if I just split the bet up into a ton of smaller tickets? Like say $100 and +600, but just do that 80 times. Will the book make a scene of it if I walk up to them with 80 winning tickets of the exact same bet? Would they still make me fill out a form since the cumulative win is over the threshold?

Any advice or knowledge about this is appreciated, thanks guys.

Let's say for example it's Medvedev at +600. If I put $7k on Medevedev to win at the casino, will they make me fill out an IRS form if/when I cash the ticket? I know they do this for a minimum win of $1,200 if you hit a slot or something like that, but I have no idea how it would work with a sports wager. Is there a minimum win where they make you fill out a form?

If this is the case and they will give me an IRS form to fill out, what would happen if I just split the bet up into a ton of smaller tickets? Like say $100 and +600, but just do that 80 times. Will the book make a scene of it if I walk up to them with 80 winning tickets of the exact same bet? Would they still make me fill out a form since the cumulative win is over the threshold?

Any advice or knowledge about this is appreciated, thanks guys.